Health And Safety Concerns In The Construction Industry

Health and Safety in Construction

The HSE RIDDOR (Reporting of Injuries, Diseases and Dangerous Occurrences Regulations) reports from the past six years in the construction industry offer a visual representation of the most fatal sector in the UK. We explore health and safety in construction.

Don’t let employee injury become an accepted aspect of your workplace. Start by taking a closer look at these statistics and finding ways to combat the most commonly identified safety concerns. For more information, contact NC Insurance today.

Common Health & Safety Risk Factors

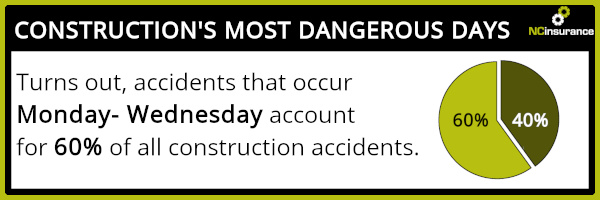

The research found that Monday – Wednesday are the most dangerous days in construction with around 60% of all construction accidents taking place within this time.

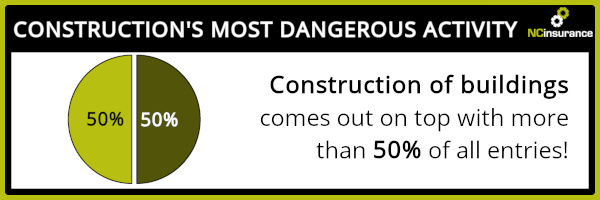

Relatively unsurprisingly, the construction of buildings is statistically the most dangerous activity, with more that 50% of all the entries.

Injury, Disease and Dangerous Occurrence Breakdown

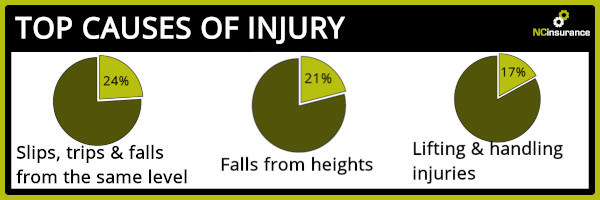

Slips, trips & falls came out on top for the largest number of injuries, with 24% of all construction related injuries occurring this way.

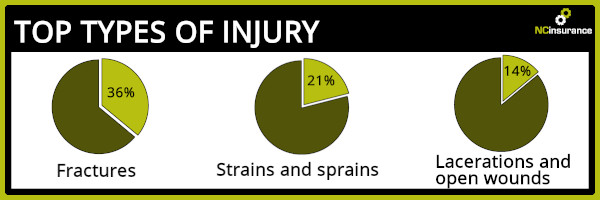

When it comes to the type of injury, one clear winner stands out above the rest. Fractures, accounting for more than 2/3rd’s of all injuries.

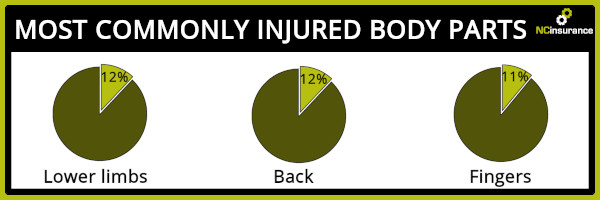

The data also revealed the most commonly injured body parts, with lower limbs, back & fingers taking the top three spots retrospectively.

What You Can Do

- Encourage a safe working culture by implementing risk management strategies and enforcing workplace health and safety policies.

- Ensure your organisation is compliant with HSE laws and regulations.

- Purchase robust insurance cover. Contact us today for on 0191 482 1219 for additional guidance, or alternatively visit our site to see how we could assist your organisation.

NC Insurance- Construction Safety

If you’re worried about new electrical inspections for landlords or how any changes you’ve been required to make may affect your insurance policy, make sure to call a member of our team at NC Insurance. We can arrange a review of your existing policy to ensure you’re covered for what you need. Call us on 0191 482 1219.

If you fancy reading more, why not check out one of our previous posts?

|  |  |